Explore the Trump tariff delay market reaction as a 90-day pause sends stocks soaring. Discover the impact on tech, sentiment, and global volatility.

The Trump tariff delay market reaction has been swift and dramatic. Following the President’s announcement of a 90-day pause on new tariffs targeting China, the U.S. stock market responded with a historic rally.

📊 Trump’s Tariff Delay Triggers Historic Stock Market Rally

On April 9, 2025, President Donald Trump officially announced a 90-day delay in implementing his planned reciprocal tariffs against most major U.S. trade partners — with the notable exception of China. The move triggered a massive rebound in U.S. equities, as investors priced in short-term relief from trade tensions.

📰 What Happened?

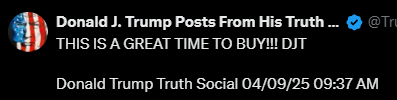

Earlier in the day, Trump posted on X (formerly Twitter), stating:

“It’s a great time to invest in America. Big things are coming.”

“THIS IS A GREAT TIME TO BUY!!! DJT”

Just hours later, the White House confirmed a 90-day pause on tariffs, sparing countries like Germany, Japan, and South Korea. However, China will still face elevated tariffs of up to 125%, as part of ongoing U.S.-China economic friction.

📈 Market Impact

Analysts weighed in on the Trump tariff delay market reaction…

- S&P 500: +9.6% – its largest one-day gain since 2020

- Nasdaq Composite: +12.2% – highest single-day jump in over two decades

- Dow Jones: +8.4% – led by gains in industrials, tech, and retail

Tech and consumer-facing sectors led the charge, with Apple, Amazon, and Tesla all posting double-digit intraday gains.

📈 Market Surge Despite Fear: Tech Leads the Charge

On April 9, 2025, following Trump’s unexpected announcement to delay tariffs on China by 90 days, U.S. markets soared across all sectors, with Big Tech leading the rally.

🔍 Visual Insight – Market Tracker

- NVIDIA +18.72%, TSLA +22.69%, AAPL +15.33%, MSFT +10.13%, and AMZN +11.98% reflect investor optimism around lifted short-term policy pressure.

- The rally also touched financials (JPM +8.06%, BRK.B +5.84%), semiconductors (AVGO +18.66%), and communication giants (GOOG +9.88%, META +14.76%).

- This broad-based optimism indicates how deeply the market was weighed down by tariff uncertainty.

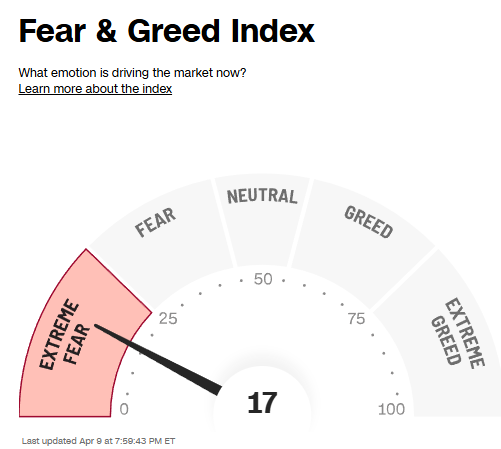

Despite the historic spike, market sentiment remains skeptical.

😨 Extreme Fear Lingers – Investor Psychology Split

- The Fear & Greed Index sits at just 17 (Extreme Fear).

- This gap between market performance and investor sentiment highlights:

- Persistent concern over China’s still-elevated tariffs

- Doubts about the sustainability of the rally

- Fear that the delay may be political maneuvering, not a policy shift

📌 Investment Takeaways

✅ Opportunities

Tech, semiconductors, and consumer discretionary sectors benefit most from tariff relief optimism, driving broad equity momentum.

- Tech, Retail, Auto Stocks: Immediate relief from higher import costs

- Short-Term Momentum: Bullish sentiment could drive a Q2 rally

- Emerging Markets: Risk-on flows may return temporarily as U.S. equities stabilize

⚠️ Risks

Tariff talks may stall or reverse, Fed policy shifts, or renewed China tension could trigger profit-taking and market pullback.

- China Still Penalized: Ongoing tariffs on Chinese imports could reignite supply chain issues

- Temporary Relief: The 90-day window adds a new deadline to markets

- Retaliatory Moves: China’s response remains uncertain

- Fake News Risk: Similar to April 7’s false tariff rumor spike, volatility from misinformation persists

📉 What to Watch Next

🌏 Global Reaction:

Asian markets rallied on easing trade fears; EU stocks followed, especially export-heavy sectors like autos and industrials.

- China’s official response – Could include counter-tariffs or regulatory pressure

- USTR updates and Fed commentary – Both will shape investor expectations

- Earnings season – Q1 results may show early signs of tariff pressures

- Political dynamics – 2025 election cycle may influence trade posturing

Leave a Reply