The Trump 90-Day Tariff Delay Market Impact is sending shockwaves across global exchanges, as investors respond with renewed optimism and strategic repositioning.

(sourced: CNN)

Market Sentiment Snapshot – April 10, 2025

Despite a record-breaking rally driven by tariff delays, the Fear & Greed Index remains at 13, signaling Extreme Fear. This sharp contrast highlights investor anxiety beneath surface-level gains, pointing to persistent uncertainty in the markets.

📈 Market Overview: Historic Rally Amid Trade Tensions

On April 9, 2025, President Donald Trump announced a 90-day delay on new tariffs for all countries except China. This unexpected move led to a historic surge in U.S. stock markets:

• Nasdaq Composite: +12%

• S&P 500: +9.5%

• Dow Jones Industrial Average: +8%

This rally marked one of the most significant single-day gains in recent history, driven by investor optimism over potential easing of trade tensions.

🧠 Factors Behind the Rally

1. Federal Reserve’s Supportive Stance

Investors are betting on the Federal Reserve’s willingness to cut interest rates or provide liquidity support if market volatility increases. Comments from Fed officials hinting at policy flexibility have helped calm investor fears.

2. Tariff Fatigue

After years of fluctuating U.S.-China trade relations, markets may have become desensitized to tariff announcements. This “bad news fatigue” could be muting negative reactions to trade-related news.

3. Strong Corporate Earnings

Financial giants like JPMorgan Chase and Citigroup reported better-than-expected Q1 earnings, boosting investor confidence and driving optimism in the financial sector.

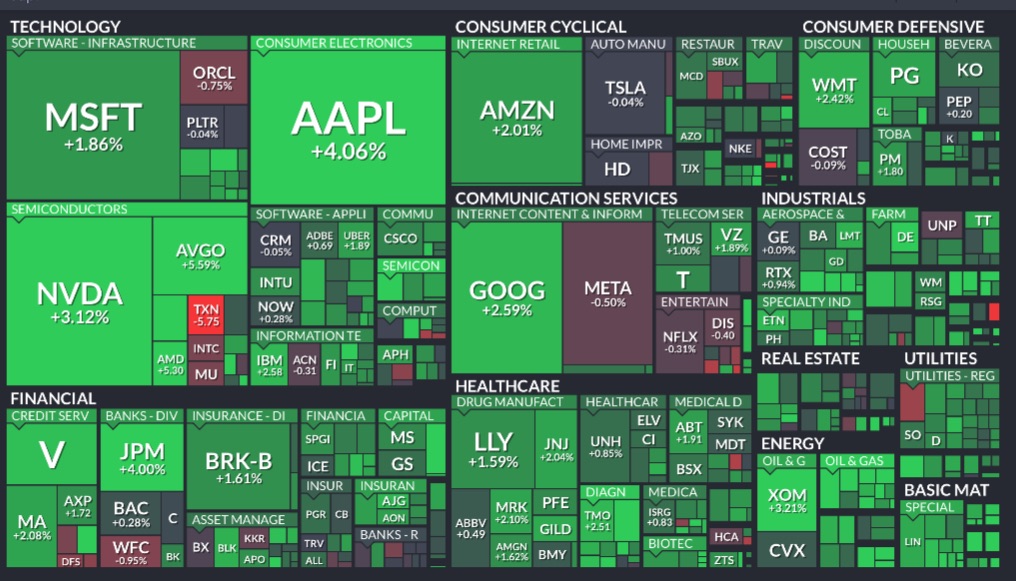

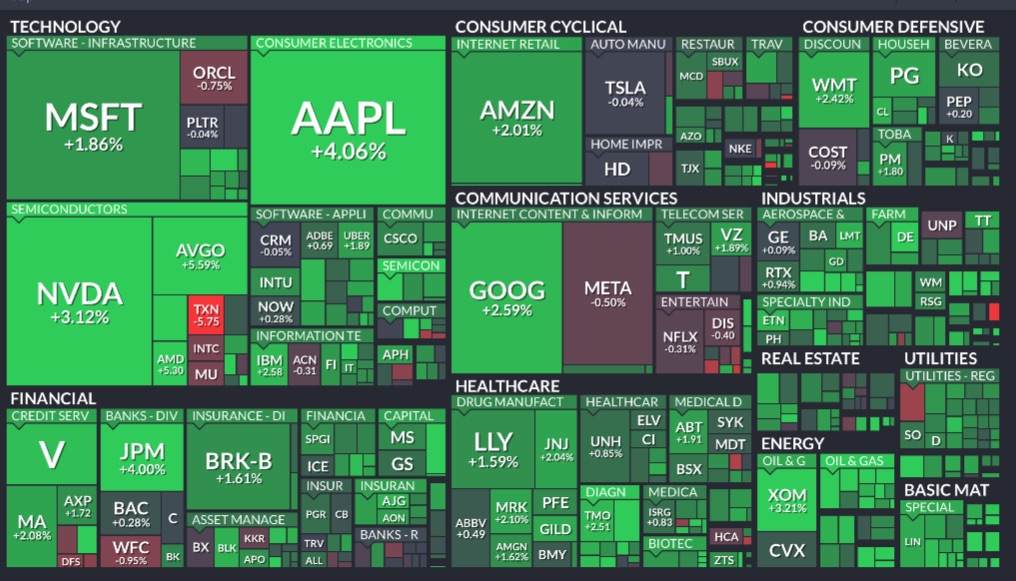

🔍 Sector Performance & Stock Highlights

📊 Top Gainers

• Nvidia (NVDA): +2.5%

• JPMorgan Chase (JPM): +3.7%

• Apple (AAPL): +4.0%

⚠️ Stocks to Watch

• Tesla (TSLA): -0.7%

• Wells Fargo (WFC): -1.2%

• BlackRock (BLK): -0.9%

🧭 Investment Strategies Amid Uncertainty

• Diversify Internationally: Focus on stable sectors like healthcare and utilities to mitigate regional risks.

• Monitor Tariff Developments: Stay informed on trade negotiations, especially between the U.S. and China.

• Focus on Fundamentals: Invest in companies with strong balance sheets and consistent earnings.

• Hedge Against Volatility: Consider defensive assets like gold and Treasury bonds to protect against market swings.

📉 Remaining Risks

• Persistent Trade Tensions: Despite the tariff delay, the U.S.-China trade war continues, with China maintaining high tariffs on U.S. goods.

• Market Volatility: Rapid market movements may continue as investors react to new developments.

• Economic Indicators: Upcoming inflation data and earnings reports will play a crucial role in shaping market sentiment.

📈 Investor Reactions to Trump’s 90-Day Tariff Delay

Investors welcomed the announcement with enthusiasm. Tech giants like Apple, Nvidia, and Tesla soared as reduced short-term trade pressure eased margin concerns. The S&P 500 gained over 4%, while the Nasdaq hit a new monthly high.

Economic analysts from Bloomberg and CNBC highlighted that the Federal Reserve may keep rates steady amid reduced inflation risk, further fueling the market rally.

🌐 What’s Next for Global Trade?

Despite the temporary delay, the trade war with China is far from over. The U.S. Trade Representative emphasized continued tariff discussions, leaving future hikes on the table. Investors should remain cautious of renewed volatility in the second half of 2025.

💡 Investment Strategy Tips:

- Watch tech and retail for continued upside

- Stay diversified across global markets

- Use VIX volatility and Fear & Greed Index as sentiment tools

- Hedge with safe-haven assets like bonds and defensive ETFs

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Investors should conduct their own research or consult a financial advisor before making investment decisions.