On April 2, 2025, the U.S. will launch a series of aggressive tariffs under Trump’s “Liberation Day” policy, targeting foreign-made automobiles, Trump’s 2025 tariff investment analysis shows that these new trade measures are reshaping key sectors of the U.S. economy.pharmaceutical imports, copper, lumber, and China-based products. These new economic policies aim to boost domestic production but could spark renewed volatility across global markets.

Let’s break down the policy highlights, sector-wise impact, and competing forecasts about how these tariffs might shape your investment portfolio.

📊 Key Tariff Policies Effective April 2, 2025

| Sector | Tariff Details | Target Region |

|---|---|---|

| Automobiles | 25% tariff on foreign-made vehicles and parts | Global (Excl. USMCA) |

| Pharmaceuticals | New taxes on imported drugs | China, EU |

| Raw Materials | Tariffs on copper, lumber | Global |

| Oil Imports | 25% on oil from Venezuela due to border concerns | Venezuela |

| China Imports | Extra 20% duty citing fentanyl & trade imbalance | China |

📝 Source: AP News, New York Post

💥 Sectoral Impact of Trump’s 2025 Tariffs

🚗 Auto Industry

- Negative Impact: Tariffs increase costs for imported parts, hitting companies with global supply chains like Toyota and BMW.

- Positive Impact: Boosts U.S.-based manufacturers such as GM and Ford if domestic consumption rises.

💊 Pharmaceuticals

- Tariffs could disrupt the import of generic medications, leading to price hikes and supply chain disruptions.

⚙️ Materials & Commodities

- Construction and manufacturing sectors may face higher input costs for lumber and copper, potentially slowing infrastructure projects.

🏭 Tech and AI Sectors

- NVIDIA, Intel, and Apple may face further strain if China retaliates or if supply chains get disrupted.

📉 Market Response So Far

- The S&P 500 has dropped 5.1% this quarter, with a 10% correction from February highs.

- Investor sentiment remains mixed, as the market evaluates if tariffs are temporary leverage or long-term structural shifts.

📌 Source: WSJ Market Report

📉 Trump’s 2025 Tariff Investment Analysis: Market Volatility and Inflation Risks

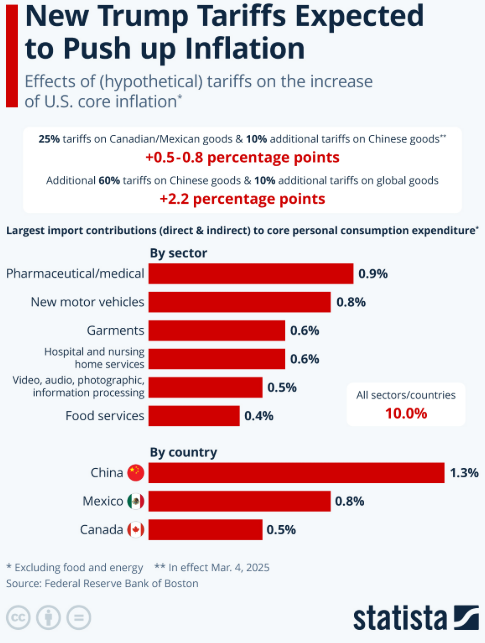

Trump’s 2025 tariff policies are expected to inject significant volatility into global markets, fueling investor uncertainty and inflation concerns. With new tariffs on automobiles, pharmaceuticals, copper, and Chinese goods taking effect on April 2, both input costs and consumer prices are forecasted to rise.

- Increased Market Volatility

Financial markets have already reacted with instability. Major indices like the S&P 500 dropped 5.1% this quarter, reflecting heightened risk aversion as trade tensions escalate.

📰 Source: WSJ

- Inflationary Pressures on the Rise

St. Louis Fed President Alberto Musalem warned that prolonged tariffs could lead to “more persistent inflation.” As companies pass higher costs onto consumers, core inflation may accelerate.

📰 Source: Reuters

- Trump’s 2025 Tariff Investment Analysis and U.S. Growth Slowdown Concerns

A study by the Peterson Institute forecasts that if Trump’s 25% tariffs extend to Canada and Mexico, U.S. GDP growth could drop by 0.2 percentage points annually, and inflation could rise by 0.43 points in 2025.

📰 Source: Yonhap News

Investor Takeaway:

As uncertainty deepens, investors are urged to monitor Fed policy, diversify holdings, and prepare for short-term shocks while identifying long-term sector winners.

📈 Bullish vs. Bearish Scenarios – What’s Next?

🟢 Bullish Outlook

- If April 2 marks a turning point, markets may stabilize.

- Domestic industries gain pricing power.

- Potential Fed rate cuts later in the year may boost risk assets.

“April has historically been one of the strongest months for U.S. equities,” notes MarketWatch.

🔴 Bearish Outlook

- Ongoing uncertainty and unpredictable policy shifts could prolong volatility.

- Inflationary pressures could return, prompting hawkish monetary responses.

- China or EU retaliation could escalate into a new trade war.

📌 Analyst Commentary:

“Investors hoping for post-April clarity might be disappointed,” warns MarketWatch.

💼 Investor Takeaways: Risk or Opportunity?

✅ Recommended Investment Strategies

- Hedge Tariff Risk: Use ETFs with U.S.-centric exposure (e.g., SPY, IWM).

- Focus on Domestic Leaders: Industrials like Caterpillar, Deere, and Ford may benefit.

- Watch China-Exposed Stocks: Tech giants like NVIDIA, Tesla, and Apple may remain volatile.

🔗 Related Articles

- NVIDIA Investment Analysis: Navigating Geopolitical Risks

- How Trump’s Trade Policy is Reshaping the Global Economy in 2025

✨ Final Thoughts

Trump’s 2025 tariffs represent a major shift in U.S. trade strategy. While risks abound—particularly for globally integrated sectors—savvy investors can capitalize on new opportunities if they stay informed and adjust their strategies accordingly.