A false rumor about a Trump tariff delay caused market whiplash on April 7, 2025. Explore the sharp Nasdaq surge, investor behavior, and how misinformation drives volatility.

On April 7, 2025, the U.S. stock market experienced significant volatility due to an unverified social media post falsely claiming that President Donald Trump was considering a 90-day pause on impending tariffs. This misinformation led to a rapid surge in major indices, including the Nasdaq, followed by an equally swift decline once the news was debunked. Politico+1WSJ+1

Positive Impacts and Investor Expectations:

- Market Responsiveness: The immediate surge in stock prices upon the rumor’s release demonstrated the market’s sensitivity and potential optimism regarding tariff relief. Investors appeared eager for any indication of de-escalation in trade tensions, suggesting that official announcements of tariff delays or negotiations could bolster market confidence.

- Sectoral Gains: Sectors adversely affected by tariffs, such as technology and manufacturing, saw brief upticks, indicating that confirmed tariff pauses could lead to substantial gains in these areas.Fox Business+5Business Insider+5AP News+5

Risks and Considerations:

- Credibility of Information Sources: The incident underscored the dangers of reacting to unverified information. Investors relying on such sources risk making decisions based on false premises, potentially leading to financial losses.

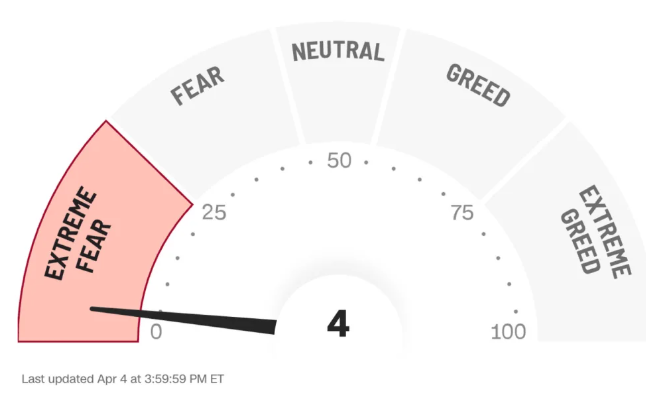

- Market Volatility: The rapid oscillation between gains and losses highlighted the current market’s fragility and susceptibility to news—both accurate and inaccurate. This environment can erode investor confidence and contribute to a more cautious investment climate.

- Policy Uncertainty: The swift market reactions reflect underlying uncertainties regarding trade policies. Without clear and consistent communication from policymakers, markets may continue to experience turbulence.

Conclusion:

The events of April 7, 2025, serve as a reminder of the market’s current volatility amid ongoing trade disputes. While the initial surge in response to the false tariff delay rumor indicates potential positive reactions to actual policy easing, the subsequent decline emphasizes the risks associated with misinformation. Investors are advised to exercise caution, verify information through reliable sources, and remain prepared for continued market fluctuations as trade policies evolve.

Fear and Greed Index (CNN) – A Brief History

Relating Articles