Trump Tariff Exemptions Electronics 2025 policy boosts tech giants like Apple and Nvidia. Discover stock market reactions, sector benefits, and investor outlook.

Link to The White House Report

The Trump Tariff Exemptions Electronics 2025 announcement has reshaped tech investor sentiment, triggering a strong stock rally and sector-wide optimism.

usatoday and usatodaypolitics

📈 Market Overview: Tech Stocks Surge Amid Trump Tariff Exemptions Electronics 2025

On April 12, 2025, the Trump administration announced significant exemptions on tariffs for key electronic products, including smartphones, laptops, and semiconductors. This policy shift provided immediate relief to major tech companies and sparked a notable rally in tech stocks.AP News

🧾 Key Highlights

- Tariff Exemptions: Smartphones, computers, and semiconductor equipment are now exempt from the previously imposed 145% tariffs on Chinese imports.

- Market Reaction: Tech giants like Apple and Nvidia experienced stock surges following the announcement, reflecting investor optimism.

- Consumer Impact: The exemptions are expected to prevent significant price hikes on consumer electronics, alleviating inflationary pressures.

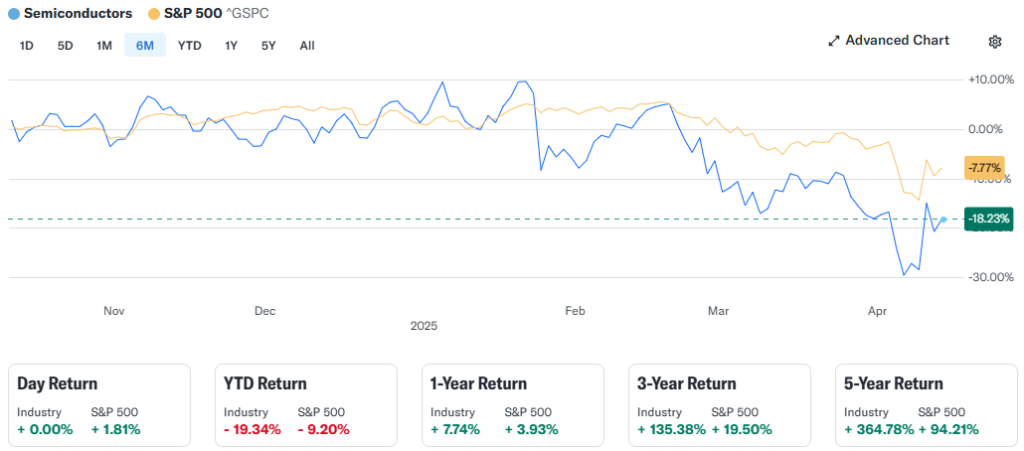

📈 Expectation of Semiconductor Stocks and S&P 500 by Tariff Exemptions

(Sourced by Yahoo Finance)

Semiconductor Stocks vs. S&P 500: A 6-Month Comparative Analysis Amid Trump Tariff Policy

– Performance Overview (Last 6 Months):

- Semiconductors: -18.23%

- S&P 500: -7.77%

This chart clearly shows that semiconductor stocks have underperformed the broader S&P 500 index over the past 6 months. While both sectors began the period relatively aligned, a divergence emerged in late February to early March, where semiconductor stocks began a steeper decline—eventually falling nearly 2.5x more than the overall market by mid-April 2025.

– Expectation

Trump’s surprise exemption of tariffs on electronics, including semiconductors and smartphones, eased investor fears and sparked renewed optimism. The S&P 500 is expected to stabilize as broad economic concerns fade slightly, while semiconductor stocks, which had plunged sharply, now show strong rebound potential fueled by supply chain relief and tech demand.

🏢 Sector Impact Analysis

Apple Inc. (AAPL)

- Manufacturing Relief: With a substantial portion of its products assembled in China, Apple benefits directly from the tariff exemptions.가디언

- Stock Performance: Apple’s stock rebounded sharply, recovering losses incurred after the initial tariff announcements.MarketWatch

Nvidia Corp. (NVDA)

- Supply Chain Stability: As a leading semiconductor company, Nvidia gains from the exclusion of chip-making equipment from tariffs.

- Market Confidence: Investors responded positively, boosting Nvidia’s stock value amid the eased trade restrictions.

🏢 Additional Beneficiary Companies from Trump Tariff Exemptions Electronics 2025

1. Dell Technologies (DELL)

- Why: Major U.S. computer manufacturer with a significant portion of its supply chain in China.

- Benefit: Lower import costs on laptops and components boost profit margins.

2. HP Inc. (HPQ)

- Why: Heavily dependent on Chinese assembly for laptops, desktops, and printers.

- Benefit: Tariff exemptions prevent product price hikes and support global competitiveness.

3. Microsoft Corporation (MSFT)

- Why: Produces Surface devices and Xbox consoles in China.

- Benefit: Exemptions reduce hardware-related cost pressures and help preserve margins.

4. Samsung Electronics (SSNLF)

- Why: Though Korean-based, Samsung relies on Chinese component production and final assembly for many products.

- Benefit: Avoids U.S. tariffs on imported electronics, maintaining pricing strength in the U.S. market.

5. Intel Corporation (INTC)

- Why: Supplies semiconductors and chipsets, often dependent on Chinese subcontractors for packaging and testing.

- Benefit: Tariff relief supports demand from OEM partners like Dell and HP, and stabilizes global supply chains.

These companies can be classified as secondary beneficiaries, as they are likely to experience reduced tariff burdens, improved profit margins, stabilized revenues, and growing investor optimism for potential stock price appreciation.

🌐 Broader Economic Implications

- Tech Industry Relief: The exemptions mitigate immediate financial pressures on the tech sector, fostering a more stable investment environment.

- Trade Relations: While providing short-term relief, the exemptions do not signify a resolution to the broader U.S.-China trade tensions.

- Future Uncertainties: Analysts caution that the exemptions may be temporary, with potential for future trade policy shifts affecting the tech industry.

🔮 Investor Takeaways

- Short-Term Opportunities: Investors may find favorable conditions in tech stocks due to the immediate relief from tariff pressures.

- Long-Term Vigilance: Continued monitoring of trade policies is essential, as future changes could impact the tech industry’s stability.

- Diversification Strategy: Considering the ongoing trade uncertainties, a diversified investment approach remains prudent.

Conclusion

The Trump administration’s decision to exempt certain electronics from tariffs marks a notable development in U.S.-China trade relations. While it offers immediate benefits to consumers and tech companies, the long-term implications depend on future policy decisions and ongoing trade negotiations.

For more detailed information, refer to the official announcement by U.S. Customs and Border Protection and analyses from reputable financial news outlets.

Leave a Reply